Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

LSP.Finance is a user-centric digital asset management platform transforming DeFi by unlocking liquidity from PoS Networks, Early-Stage Alphas, and High-Yield Projects.

By prioritizing accessibility and innovation, LSP creates a thriving blockchain ecosystem, offering an all-in-one platform that allows users to achieve high liquidity.

As an application built on Arbitrum, LSP.Finance's smart contract architecture leverages the cross-blockchain communication (LayerZero & LSP's Relayer protocols, as well as Particle Wallet abstraction, chain abstraction, and LSP's own built-in, no-frills, chain-slicing wallet module, to enable the protocol to provide the easiest and most convenient liquidity staking service, continuously upgrading and expanding it to deliver a seamless user experience similar to centralized apps, making it more accessible and lowering the learning curve for users.

LSP.Finance's architecture consists of contracts that control the flow of assets across multiple blockchains via chain communication/chain abstraction and wallet abstraction. After a user completes a transaction and the protocol receives a message of support, the protocol mints multiple liquid pledge receipt tokens (called f/sAssets & Earn) using the Token Factory standard.

$LSP is protocol utility and governance token , hold $LSP can receive protocol's revenue!

Token Name: LSP.Finance protocol token

Token Ticker: LSP

Token Decimals: 18

Total Supply: 1,000,000,000

• Participate in setting key LSP protocol parameters (fees, limits, and margin requirements) through voting and proposals.

• Stake to earn dividends from the LSP protocol.

• More Features: Reduced market fees and enhanced yields (more details to be announced).

The architecture of LSP.Finance is designed to ensure scalability, security, and usability. It comprises the following core components:

• Simplifies user interactions by enabling seamless integration across multiple networks and interfaces.

• Supports unified management of assets and staking processes without requiring in-depth technical knowledge.

• Facilitates cross-chain operations, allowing staked assets to achieve interoperability across different blockchain ecosystems.

• Ensures compatibility and ease of integration with new networks in the future.

• Provides tokenized representations of staked assets, enabling liquidity while the underlying assets remain locked in staking pools.

• Supports passive PoS rewards and free trading within the LSP ecosystem and beyond.

• Implements uniform coding standards to streamline staking pool creation and protocol upgrades.

• Promotes permissionless access for asset providers to build and manage staking pools efficiently.

This modular architecture empowers users and asset providers, making staking simpler, more flexible, and widely accessible.

• Arbitrum One

• MANTA Pacific

• MANTA Atlantic

• ALEO Network

Coming soon...

Fixed staking pools, also available for Aleo and Manta, offer predetermined staking conditions, allowing users to stake with fixed terms.

Unlike Flexible Staking, Fixed Staking restricts asset unlocking to a specific time period. However, compared to Flexible Staking, Fixed Staking offers higher returns.

Simplified Asset Data: Concise and easy-to-read asset information.

Position Details: In-depth display of current holdings and positions.

Platform Interaction History: A detailed log of past interactions for for quick and easy reference.

Coming soon...

Join the LSP Ecosystem and Earn Generous Rewards!

We are excited to announce the launch of the LSP Airdrop Campaign! By participating in our diverse range of activities, you can not only experience various features of the platform but also earn exclusive rewards.

Season 1 Points Activity has Ended, Season 2 is Coming Soon!

Thank you for your active participation in Season 1! The points distribution has been completed. Now, we are gearing up for the launch of Season 2! More rewards and exciting opportunities await you.

Whether you're a new user or an existing member, there will be plenty of ways to earn points and claim rewards in Season 2. Join us, explore the latest features, and enjoy the rewards!

Coming soon...

Click [Detail] to enter the corresponding pool and view more information.

Click [Fixed Staking], select the corresponding pool

click [Learn More]

If there is an existing position in Fixed Staking, you can view the following data:

Staked Amount (in base currency): The total amount of assets you have staked in the fixed staking pool, displayed in the base currency.

Total Earnings: The total rewards earned from the staked assets up to the current time.

Last 24H Earnings: The earnings from the last 24 hours.

Withdrawable Balance: The amount of staked principal that can be withdrawn after the staking period ends (once the exit time has passed).

The f/s Token is automatically generated from native token staking in LSP.Finance and facilitates staking, unstaking, and reward claiming.

A LST represents a tokenized certificate of staked assets, providing liquidity for stakers while their underlying assets remain locked in staking pools on the target chain. With LSTs, stakers can earn PoS (Proof of Stake) rewards passively without managing validator nodes or underlying assets. These tokens are freely tradable in the LSP marketplace and will integrate into more DeFi ecosystems, expanding their use cases and value over time.

1. Liquidity:

• When users stake their assets, they receive a tradable token, enhancing capital efficiency and liquidity.

2. Ease of Use:

• Rewards automatically accrue to the LST, allowing users to claim them as needed.

3. Flexibility:

• LSP enables users to freely trade LST tokens in the marketplace, providing a flexible mechanism for managing staked assets.

Richy is your exclusive ticket to prosperity in the "Get Rich With LSP" collection. As a proud holder of this NFT, you unlock a world of benefits and privileges designed to enhance your experience in the LSP.Finance ecosystem:

Token Airdrops: Receive exclusive airdrops of platform tokens directly to your wallet, just for being part of the Richy community.

Overview Starting from 18.Nov.2024, the LSP Bug Bounty Program ("Program") officially launches, targeting the LSP.Finance codebase to encourage responsible vulnerability disclosure. The scope of the Program is limited to critical and high-severity vulnerabilities, with rewards of up to $500,000. Happy bug hunting!

Scope The Program is limited to vulnerabilities that may result in the loss of user funds.

The following are out of scope for the Program:

Any contracts designated for testing purposes.

Vulnerabilities in third-party contracts or platforms interacting with LSP.Finance.

Coming soon...

Earn standardizes the deposit entry for multi-chain native assets and establishes a unified staking pool. Through a proposal mechanism, Earn achieves decentralization and automation by allocating staked assets to secure and high-yield providers. Additionally, Earn offers a range of selectable features, including high-yield options, stable returns, and leveraged yield extensions, providing users with a flexible and comprehensive yield management experience.

With the transition from PoW to PoS in Ethereum 2.0, staking under PoS protocols typically involves locking tokens into a project for the long term, creating validator nodes with a fixed amount of tokens, and earning predetermined staking rewards through node management. This process ensures token-based returns (denominated in the staked asset) similar to bond-like guarantees in traditional finance. However, locking funds in nodes restricts their ability to pursue higher returns from other DeFi ecosystems.

From an economic perspective, users must carefully analyze the “opportunity cost” of asset allocation to optimize returns, a process that is often complex and tedious. For instance, staking all cryptocurrencies means users cannot sell assets during a price increase, thereby limiting liquidity and reducing the ability to maximize returns.

While solutions from projects like Lido, StakeStone, and EigenLayer address some user needs for network participation, they fall short in addressing liquidity challenges for node operators. To innovate beyond these limitations, LSP introduces a groundbreaking solution.

Click on the top-right corner, then select [Address] > [My Portfolio] to enter the page.

Scroll down to the position section. If there is any available reward, click the [Claim] button on the right to claim the corresponding reward.

Custom Avatars: Use your Richy NFT as a unique avatar, showcasing your membership in this elite circle.

Beta Access: Be the first to explore and test new features with private beta invitations. Your voice will shape the future of LSP.Finance.

Revenue Sharing: Share in the platform's success with a portion of the profits distributed among NFT holders.

Richy isn’t just an NFT—it’s your golden key to a richer, more rewarding DeFi journey. Join the "Get Rich With LSP" movement today and secure your place in this prosperous community.

The total supply for this NFT collection is 3333.

1. OG Exclusive Mint

Eligibility: Addresses with OG privileges.

Price: Free to mint 1 NFT.

Amount: 100

Time Limit:

OG Mint is available for 2 hours after minting begins.

After the 2-hour window, OG addresses will lose their free mint privilege and must mint at the Public Mint price.

Address Limit: Each OG address can mint 1 NFT for free.

2. WL Exclusive Mint

Eligibility: Addresses with WL privileges.

Price: 0.08 ETH per NFT.

Amount: 1,456

Time Limit:

WL Mint is available for 24 hours after minting begins.

After the 24-hour window, WL addresses will lose their discount privilege and must mint at the Public Mint price.

Address Limit: Each WL address can mint 1 NFT at the discounted price.

3. Public Mint

Eligibility: All users who do not hold OG or WL privileges, or those who have lost their OG or WL privileges.

Price: 0.1 ETH per NFT.

Amount: 1,777-3,233(Depends on the Og&WL minting status)

Minting Period: 7 Days since minting start

Address Limit: Each address can mint up to 5 NFTs in total (including NFTs minted during the OG and WL phases).

Any unminted OG-exclusive NFTs (100 total) will be added to the WL and Public Mint pools after the OG phase ends.

The final available supply for WL and Public Mint will include any unminted OG NFTs + the initial 1777-3233 NFTs(Depends on the Og&WL minting status) allocated for WL and Public.

Mint Start Time: To be announced—please follow official updates.

OG Mint Phase: Active for 2 hours after minting starts.

WL Mint Phase: Active for 24 hours after minting starts.

Public Mint Phase: 7 Days since minting start

Connect Wallet: Use a supported wallet (e.g., Okx Web3 Wallet) to connect to the mint website.

Eligibility Check: The system will automatically verify if your wallet address is on the OG or WL list.

Payment and Minting:

OG addresses mint for free, paying only the gas fee.

WL addresses mint at a discounted price of 0.08 ETH.

Public users mint at 0.1 ETH per NFT.

Mint Completion: Upon successful minting, the NFT will be automatically transferred to your wallet.

Gas Fees: Gas fees apply during the minting process; ensure your wallet has sufficient ETH.

Immutable Rules: Once minted, NFTs and the payment amount cannot be refunded or altered.

Real-Time Updates: The minting progress will be displayed in real-time. You can check the remaining supply and minted quantity at any time.

Vulnerabilities already reported or discovered in contracts built by third parties on LSP.Finance.

Any already-reported vulnerabilities.

Additionally, vulnerabilities contingent upon the following scenarios are also out of scope:

Frontend (UI) bugs.

Distributed Denial-of-Service (DDOS) attacks.

Spamming.

Phishing.

Exploits in automated tools (e.g., GitHub Actions, AWS, etc.).

Compromise or misuse of third-party systems or services.

Rewards Rewards will be allocated based on the severity of the disclosed vulnerabilities and will be evaluated and distributed at the sole discretion of the LSP.Finance team. For critical vulnerabilities that lead to the loss of user funds (over 1% or exceeding user-specified slippage tolerance), rewards of up to $500,000 will be granted. Rewards for lower-severity vulnerabilities will be determined by the team. Additionally, all vulnerabilities disclosed prior to the mainnet launch will be eligible for higher rewards.

Disclosure Requirements Any discovered vulnerabilities or issues must be reported via email to [email protected]. The vulnerability must not be disclosed publicly or to any other person, entity, or email address before LSP.Finance has been notified, has resolved the issue, and has granted permission for public disclosure. Furthermore, disclosure must occur within 24 hours of the vulnerability's discovery.

A detailed vulnerability report increases the likelihood of a reward and may lead to a higher reward amount. Please provide as much information as possible, including:

Conditions under which the vulnerability can be reproduced.

Steps to reproduce the vulnerability, or preferably a proof of concept (PoC).

Potential consequences if the vulnerability is exploited.

Anyone who reports a unique and previously unreported vulnerability resulting in code or configuration changes and who keeps the vulnerability confidential until it has been resolved by our engineers will be publicly acknowledged for their contribution, if they so choose.

Eligibility To be eligible for a reward under this Program, you must:

Discover a previously unreported, non-public vulnerability that would result in the loss of or lock on funds on LSP.Finance (but not on any third-party platform interacting with LSP.Finance) and that is within the scope of this Program.

Be the first to disclose the unique vulnerability to [email protected], in compliance with the disclosure requirements above. If similar vulnerabilities are reported within the same 24-hour period, rewards will be split at the discretion of LSP.Finance.

Provide sufficient information to enable our engineers to reproduce and fix the vulnerability.

Refrain from engaging in any unlawful conduct when disclosing the vulnerability, including through threats, demands, or any other coercive tactics.

Not exploit the vulnerability in any way, including making it public or obtaining profit (other than a reward under this Program).

Make a good-faith effort to avoid privacy violations, destruction of data, or interruption or degradation of LSP.Finance services.

Submit only one vulnerability per report unless chaining vulnerabilities is necessary to demonstrate impact.

Not submit vulnerabilities caused by the same underlying issue for which a reward has already been paid under this Program.

Not be a current or former employee, vendor, or contractor of LSP.Finance, or an employee of such vendors or contractors.

Not be subject to US sanctions or reside in a US-embargoed country.

Be at least 18 years old, or submit the vulnerability with the consent of a parent or guardian.

Other Terms By submitting your report, you grant LSP.Finance all necessary rights, including intellectual property rights, to validate, mitigate, and disclose the vulnerability. All reward decisions, including eligibility, reward amounts, and payment methods, are made at the sole discretion of LSP.Finance.

The terms and conditions of this Program may be modified at any time.

LSP allows existing nodes to map LSTs after establishing validator nodes, enabling node operators to gain liquidity without losing node control. Operators can sell a portion of LSTs for liquidity while retaining a share of node rewards. This approach maintains staking rewards and increases liquidity for engaging in other opportunities within DeFi ecosystems.

1. Enhanced Liquidity for Node Operators:

• Operators can unlock funds without sacrificing node control or rewards.

2. Interoperability:

• Facilitates node-to-LST conversion, independent of the asset’s liquidity in external markets.

3. Lower Barriers for Users:

• Reduces the complexity of staking for individual users.

• Allows participation with smaller amounts (e.g., bypassing Ethereum’s 32 ETH minimum for staking).

4. Early Access to Alpha Projects:

• Users can capture pre-launch benefits of promising projects unavailable in other markets.

5. Diverse Solutions:

• Offers a marketplace for LSTs, single-token staking, liquid staking, and other decentralized and semi-custodial protocols, covering multiple ecosystems.

• Requires technical expertise and a minimum capital threshold (e.g., 32 ETH for Ethereum validator nodes).

• Mismanagement risks locked funds, slashing, or penalties, leading to severe capital losses.

• Similar to solo staking but involves a third-party operator (often centralized).

• Users must trust the third party, exposing funds to potential attacks, misuse, or regulatory risks.

• Capital requirements remain high.

• Funds are stored centrally, lacking transparency on how they are used.

• Users risk losing liquidity and rewards and face potential security threats from concentrated funds.

• Locked assets limit financial flexibility, reducing opportunities to capture alternative returns.

• DeFi products offering LSTs address some liquidity issues but expose users to risks like assetsu3g depreciation during volatile markets.

• Centralization risks arise when a small number of validators control a majority of staked tokens.

LSP eliminates liquidity challenges for both users and validators by enhancing PoS liquidity:

1. Increased Token Circulation:

• Provides more liquidity to staked tokens without compromising rewards.

2. Maximized Returns:

• Users and validators benefit from improved liquidity to pursue additional investment opportunities.

3. Ecosystem Growth:

• Drives blockchain ecosystem prosperity by balancing rewards and liquidity across all participants.

Trust is the foundation of blockchain networks. LSP ensures trustlessness through open-source code and rigorous auditing, enabling validator nodes to operate seamlessly while mapping LSTs.

DeFi is an integral part of the Web3 ecosystem. LSP aims to continuously iterate its products and collaborate with other ecosystems to drive the prosperity of the Web3 world.

Stay tuned to official updates for the latest developments!

Aleo

Arbiturm One

sALEO

0x6a8C66dEcb40FD2d1F1429AB12A125437c7988E9

BNB

Arbiturm One

fBNB

0xcB8FbEBAA1994A535cC7A87f021C7De65F165B36

Manta

Arbiturm One

fMANTA

0x3008bEB3E883CC90f95344B875d8b0c6F224fDC0

Manta

Arbiturm One

sMANTA

0x56c02b7388dfce36c4b53878890Cf450145E23cA

Aleo

Arbiturm One

fALEO

0x16077d3455DE4Aae822eF46390ef216166803347

Note: When withdrawing ALEO staking rewards, you will need to enter the address where you wish to receive the ALEO tokens.

Click the top-right corner and select [Connect Wallet].

Click on the wallet you wish to connect.

Invoke the corresponding wallet for signature. Once the wallet is successfully connected, a message saying "Login Successful" will be displayed.

Coming soon...

Pre-Trading is designed to address issues such as overvaluation of projects, unequal opportunities between retail users and institutions, and project teams being constrained by exchanges and capital.

Our pre-trading function offers an innovative approach to unlocking early liquidity. Using a Dutch auction mechanism, projects can secure liquidity upfront - such as receiving proceeds from early token sales. This approach not only acts as a market signal but also allows for tailored engagement strategies to maximize impact in collaboration with each project.

To promote healthy development within the industry ecosystem and ensure mutual benefits for users, project teams, institutions, and exchanges, LSP.Finance has built six key features centered around Pre-Trading:

• Ensures tokens are distributed in smaller quantities at fair valuations.

• Introduces LSTs that are released progressively as the project evolves.

• Users vote for quality projects that have received funding from reputable investors.

• Proceeds from token sales are unlocked gradually through holder voting mechanisms.

• Retail users enjoy benefits and rights equivalent to venture capitalists, including the same lock-up periods

• Enables seamless and immediate trading of tokens.

This feature suite ensures fairer participation, mitigates risks, and fosters collaboration across stakeholders in the ecosystem.

LSP.Finance offers flexible staking pools across multiple chains, including options for Aleo and Manta pools, allowing users to stake on different networks with ease.

The Flexible Staking feature allows users to stake underlying assets in a flexible manner while earning stable returns. Users can freely redeem any amount of their staked assets, maximizing liquidity while continuing to receive stable rewards.

This is a GitBook modification and history record

Nov 21, 2024

Refine the overall structure.

Improve the overall framework.

Dec 20, 2024

Add Season 2 - Galaxies

Dec 27, 2024

Add fBNB Contract Address

Add BSC Contract Address

Jan 14, 2025

Add 'Richy NFT' introduction

100 points = 1x reward.

Registration

Users will receive 9.8x points upon registration.

In the early stages of LSP, an invitation system will be implemented. Users who do not register through an invitation link will only have access to staking and market sections and will not be able to participate in staking or trading.

Daily Check-in

Users who check in continuously for 7 days will receive 7x points, starting with 1x on the first day, increasing to 7x by the 7th day. If the streak is broken, the calculation will restart from day 1.

Placing Orders

Users who place an order with 50 shares on the first order of the day will receive 14x points.

Trading

For users who successfully complete a trade of over 100 USDT on their first trade of the day, both the buyer and seller will receive 70x points.

Delegated Staking

Users who successfully delegate staking of over 10 USDT on their first staking transaction of the day will receive 70x points.

Initial Activity Score = 100 points

If a user does not check in within 5 days, they will lose 10 points. The minimum activity score is 0.

If a user checks in within 5 days but has an activity score lower than 100, they will gain 5 points with each check-in. Once the score drops below 100, the maximum recovery is 90 points.

Activity Score and Point Exchange

The activity score will affect the exchange rate for converting points into tokens.

Referral Rewards

The voucher code feature is canceled, and the system adopts an invitation-only system.

Referrers will earn 10% of the points earned by the referred user.

Example: If a user earns 100 points through daily check-ins, the referrer will earn 10 points (100 * 10%).

Activity Score Change Records

The system will keep a record of activity score changes, including time, score value, type (increase or decrease), and remarks (e.g., "check-in" or "no activity for 5 days").

Staking Rules

Users must stake all available points. Staked points will earn 10% returns from node mining pools and 90% transaction market fee rewards in USDT.

Unstaking

Currently, the platform does not support unstaking of points.

Earnings Withdrawal

Earnings from staking can be withdrawn with one click, and the earnings will be distributed in the form of cryptocurrency assets.

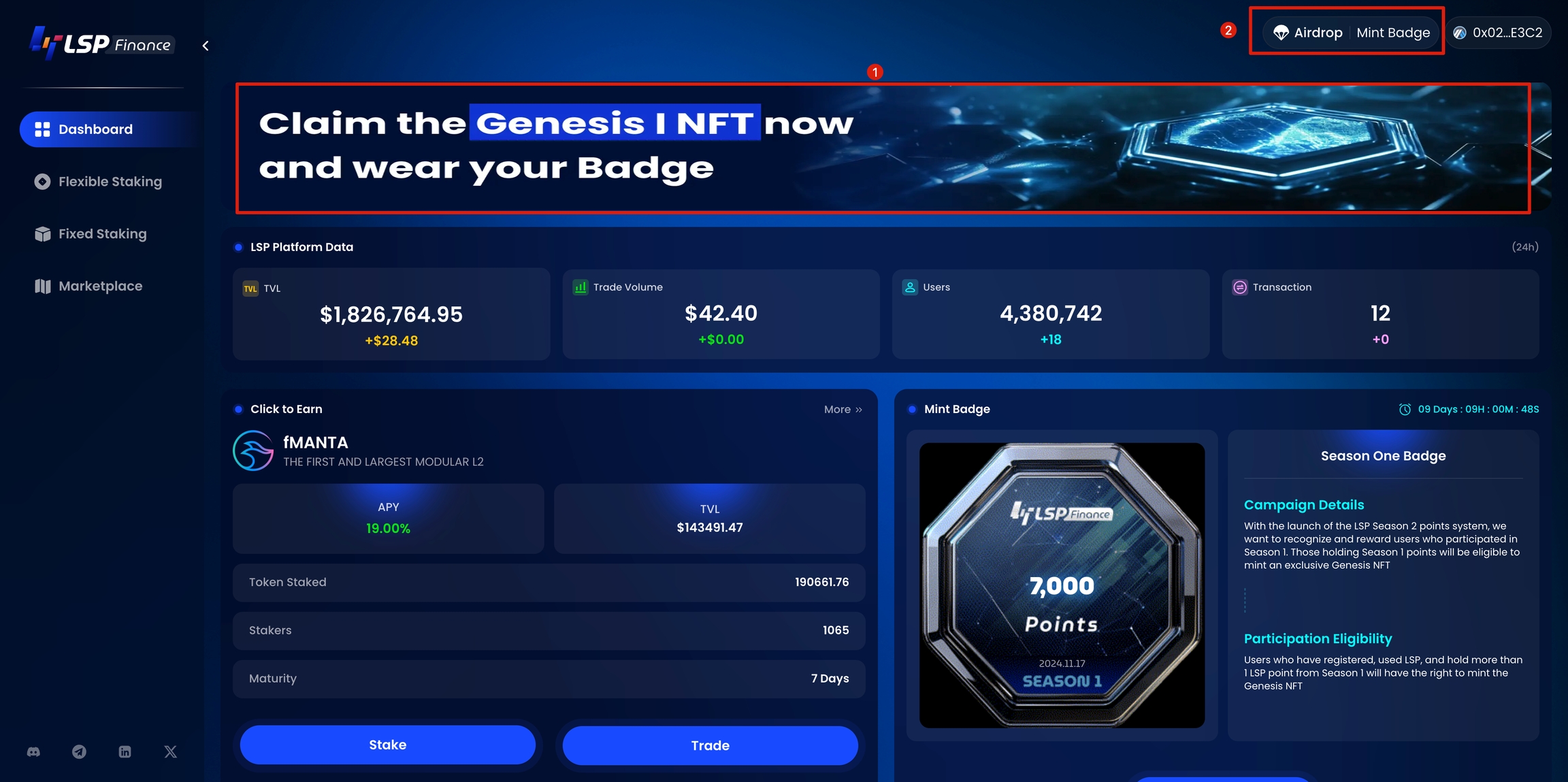

To reward early users of LSP, we are launching a limited-time Genesis NFT minting event

Click Dapp link ➡️https://app.lsp.finance/

Click the following:

【P1】 Banner

Upper right corner: Capsule

Lower right corner: Mint Now

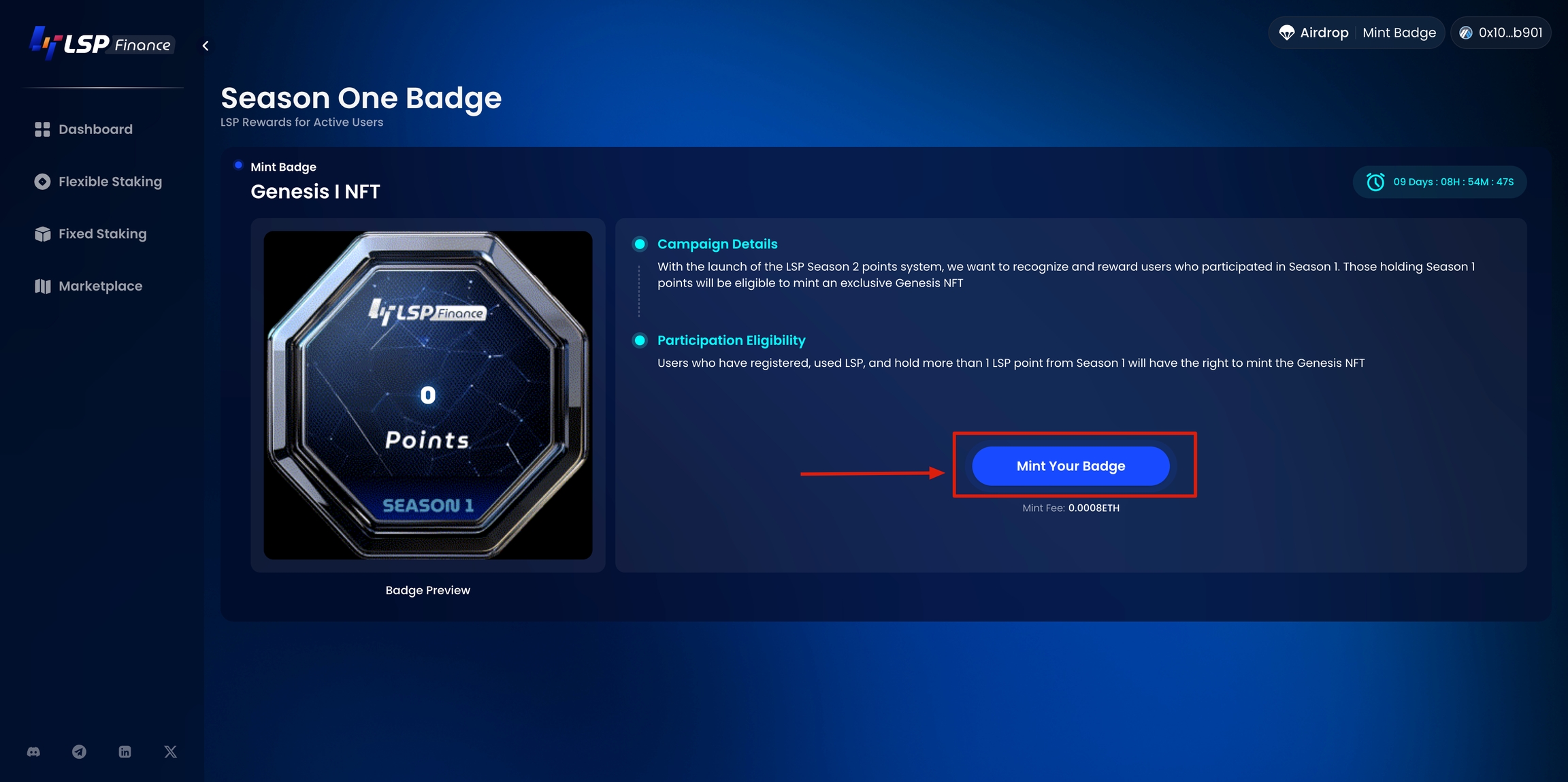

Go to the event page

Click 【Mint Your Badge】

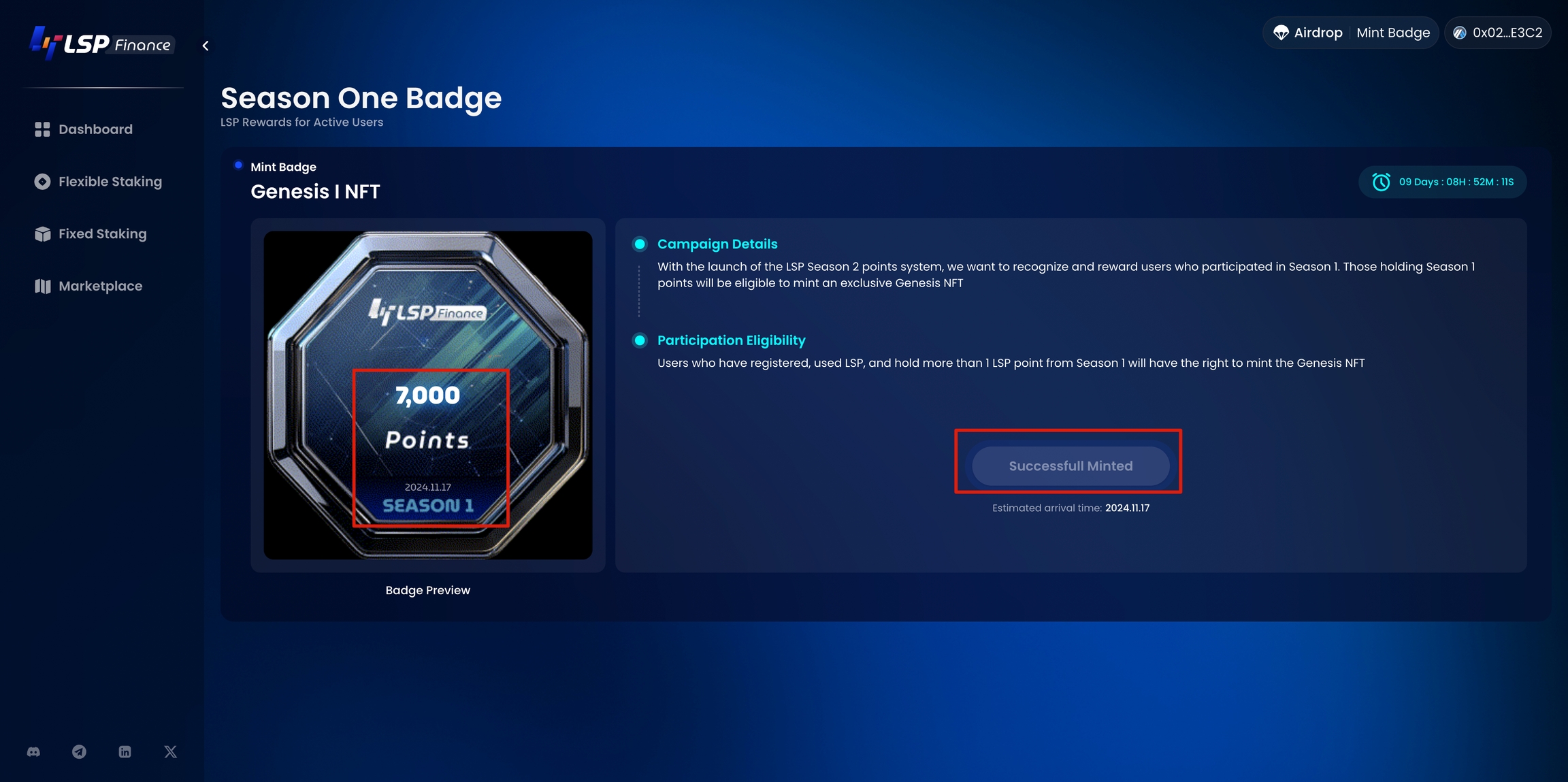

After the casting is successful, the first period of points and the date of casting of the NFT will be displayed on the NFT.

At the same time, the right side will prompt that the NFT has been successfully cast.

Click on [Marketplace] on the left to enter the page.

If you want to trade fTokens, click [Flexible Staking] and select the trading pair.

If you want to trade sTokens, click [Fixed Staking] and select the trading pair.

Scroll down to the position section on the [My Portfolio] page, and click [Trade] next to the corresponding tokenized asset to enter the trading page.

Select your preferred trading method (including: Scan Mode, Transaction Mode).

Scan Mode: Allows you to buy tokens in bulk based on market orders (this mode currently does not support bulk limit orders).

Transaction Mode: Allows you to buy or sell tokenized assets at a specific price.

Select the desired order to purchase.

The selected order's details will be displayed below, including

number of orders

amount of tokenized assets

Enter the desired price for the tokenized assets.

Enter the desired quantity of the tokenized assets to purchase.

Verify if the total amount is correct.

Proceed to place a buy order.

Enter the desired price for selling the tokenized assets.

Enter the desired quantity of tokenized assets to sell.

Verify if the total amount is correct.

Proceed to place a sell order.

After successfully placing a buy/sell order, scroll down to the Order section to review your current orders.

For orders that have not been fully executed, you can perform the following actions:

Modify Order

Cancel Order

Click [Modify] to trigger the pop-up window.

Adjust the desired transaction price for the order.

Adjust the desired transaction quantity for the order.

Click [Cancel] to cancel the corresponding order.

In Season 2, users can earn gems and experience points by completing platform tasks. Gems can be exchanged for airdrops, while experience points determine your ranking. The higher your rank, the greater the proportion of referral rewards you can enjoy. Boost your level and earn more rewards easily by completing tasks and inviting friends!

transaction amount

Click to proceed with the purchase.

STokenManager - Proxy

0x997c105964896E6ab56dE8e0466d5771ef1Ab73B

STokenManager -

lmpl

0xb19FA50b148ebDd1D6f9090cD2CF1ef4088b0948

fMANTA - Proxy

0x3008bEB3E883CC90f95344B875d8b0c6F224fDC0

fMANTA - lmpl

0x38A01b1b16196B98B1Be9530F509a2839A28aac7

sMANTA - Proxy

0x56c02b7388dfce36c4b53878890Cf450145E23cA

sMANTA -lmpl

Aleo Pledge Pool

aleo1384cfd0xpm0qfc25qjr88axd9nr6hdts775jt4u6qjpfr5wg6upqucyxch

Aleo Node Pool

aleo15xg9zjg8csszf2un0tj4usx29yc53jlgjke8hc6mjukcz96eyuxqpsmjer

STokenManager - Proxy

0x997c105964896E6ab56dE8e0466d5771ef1Ab73B

STokenManager - lmpl

0x8FBd73b7D10A3AdA0d72F66d8e59c923A5889FD6

Liquidity - Proxy

0xF51333aa66278D07F781771d9A82fc16a1a7Db35

Liquidity - lmpl

0x59414756c59A9cFF64292C6BBaeb33541470866f

ListaStaking - Proxy

0x59414756c59A9cFF64292C6BBaeb33541470866f

BSC-Messenger

0x28c4Ba10a38572AD349F08641Fa5C9Ee3178672d

ARB-Messenger

0xcB8FbEBAA1994A535cC7A87f021C7De65F165B36

Airdrop Eligibility: Gems will be one of the factors influencing the distribution of airdrop tokens. The more gems accumulated, the higher the potential airdrop token rewards.

Staking Tasks:

Flexible Staking:

The higher the cumulative spot value of USDT-based staking and the longer the staking duration, the more gems and experience points are rewarded.

Cumulative Value Calculation:

Staking value is recorded via a snapshot of the on-chain spot price at the time of each deposit.

Users can deposit multiple times to achieve the target staking value and fulfill the required consecutive staking days to earn rewards.

Consecutive Staking Requirements:

The cumulative staking value must not drop below the target amount during the consecutive days required for the task.

Newly added staking amounts only start counting consecutive staking days from the day of the deposit and do not add to the previous cumulative staking days.

Impact of Partial Withdrawals:

If a user withdraws part of the staked amount during the staking period, the withdrawn value will be deducted from the cumulative staking value. If this causes the cumulative value to drop below the target, the task cannot be completed.

Examples:

Flexible staking at 100 USDT for 7 days earns 4 gems.

Flexible staking at 1,000 USDT for 30 days earns 400 gems.

Fixed Staking:

Fixed staking rewards gems and experience points based on different cryptocurrencies and the cumulative staking value. The staking value is determined by the real-time on-chain price when the user initiates fixed staking.

Cumulative Value Calculation:

The staking value is recorded via a snapshot of the on-chain spot price at the time of each deposit.

Trading Tasks:

The higher the buy or sell volume, the more gems and experience points are rewarded.

Examples:

Cumulative buy or sell transactions worth 100 USDT on the Marketplace earn 18.75 gems.

Cumulative buy or sell transactions worth 500 USDT on the Marketplace earn 140.625 gems.

Social Tasks:

The more designated interactions completed, the more gems and experience points are rewarded.

Examples:

Retweeting, commenting, and liking specified Twitter posts (cumulative 7 posts) earns 12 gems.

Retweeting, commenting, and liking specified Twitter posts (cumulative 30 posts) earns 21 gems.

For detailed reward information on the tasks above, please visit the airdrop page: The link to the airdrop tasks and interface screenshots will be provided upon the official release.

Participate in designated pools, platform, AMA sessions, or submit optimization suggestions to earn special event gems or experience points

Invitation Mechanism:

Invite friends to join the platform and complete tasks to earn an additional 5%-20% of their gem earnings (percentage increases with user level).

Example: A Level 3 user earns 10% referral rewards from their invited friends' gem earnings.

Note: Referral rewards are capped at 50 invitees.

All tasks and reward details for LSP Season 2 are displayed on the LSP DApp Airdrop Page. After logging in, you can:

View task rules and reward details.

Track task progress and gem balance in real time.

Check your level progression and plan your upgrade strategy.

Completing tasks rewards users with gems and experience points (Exp), which are used to increase their level.

The higher the level, the greater the referral reward percentage, ranging from 5% to 20%.

Level 8 users can form guilds and earn 20% gem rewards from their referrals.

The following outlines the required experience points and benefits associated with each user level

The LSP Season 2 Airdrop Program incentivizes user participation in the ecosystem through tasks, referrals, and a growth system. Gems are the key proof for earning airdrops. By completing tasks, leveling up, and inviting friends, users can easily earn generous rewards, including airdrop tokens and exclusive platform benefits!

Visit the platform's Personal Dashboard to track task progress and check your gem balance. Start your journey in the LSP ecosystem today!

0x55Aa38BC6115eF29C87F66d4F8Dc1A622758f079

fALEO - Proxy

0x16077d3455DE4Aae822eF46390ef216166803347

sALEO - Proxy

0x6a8C66dEcb40FD2d1F1429AB12A125437c7988E9

fBNB - Proxy

0xcB8FbEBAA1994A535cC7A87f021C7De65F165B36

LayerZero Connect

0xaba95Ad3571007770118a511e569f86Efb6B0D93

Aleo Relayer

0x9a9A7E81042fb4818b41ddc88CF8B488866Bb962

Migration

0x85Cc4584Db124EC4B1b012adF1dB952C2A812084

V1 Asset Mapping Tool Contract

Marketplace

0x5C18C1CB4F50aeb87ffBc02F69fB53f5c1230FDB

Season 1 NFT Badge

0x3aF0BF91E7DA076d237d390143FDd712649fC78a

fMANTA - Proxy

0x3008bEB3E883CC90f95344B875d8b0c6F224fDC0

fMANTA - lmpl

0x1Ba126C229762c11F2e6B29f0386cFd3291419b4

sMANTA - Proxy

0x56c02b7388dfce36c4b53878890Cf450145E23cA

LayerZero Connect - messager

0x38A01b1b16196B98B1Be9530F509a2839A28aac7

Users can deposit multiple times to achieve the target cumulative staking value to earn rewards.

Examples:

Fixed staking with a value of 500 USDT in Aleo earns 300 gems.

Fixed staking with a value of 500 USDT in Manta earns 225 gems.

In the Market Function section, the platform supports the free buying and selling of tokenized assets. LSP will implement this using an order book model combined with DEX contracts, ensuring transparency in transactions and the security of users' assets.

Supported asset types for trading:

Tokenized assets mapped from all types of mining pools opened on the LSP platform.

Now available types of trading pairs:

Flexible Staking Project Pairs

Fixed Staking Project Pairs

In LSP.Finance, we classify staking into two types: Flexible Staking and Fixed Staking.

Go to the Flexible Staking page.

Select the desired underlying asset for staking (currently supported: MANTA, ALEO).

Enter the amount of the underlying asset you wish to stake.

Click [Stake].